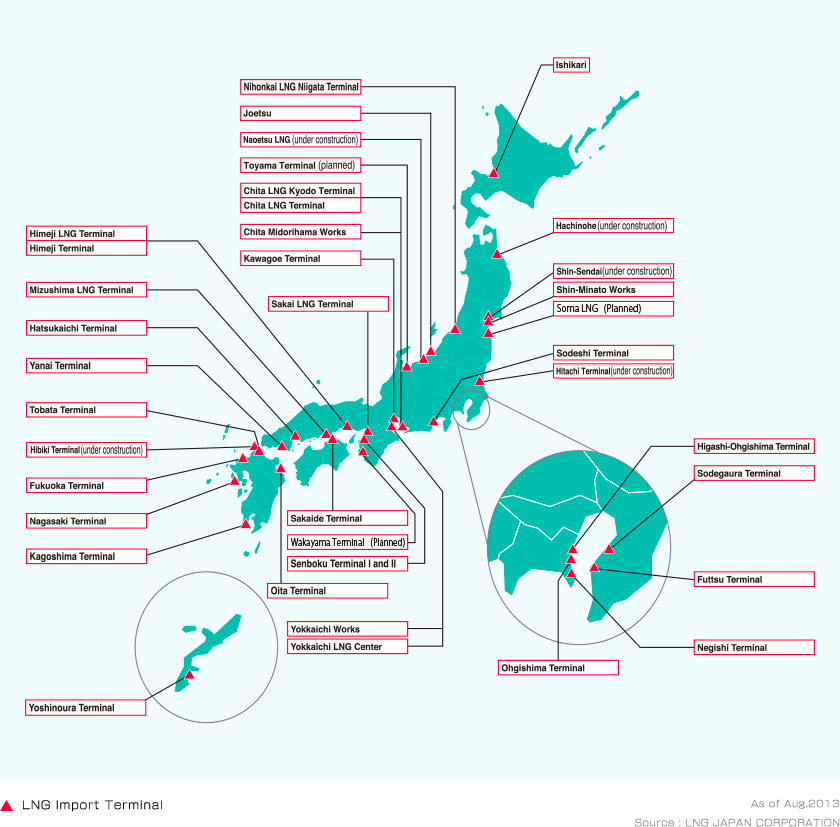

Source: LNG Japan Corporation

Source: Platts

Japanese LNG importers are expecting a muted recovery in downstream LNG demand in the second half of 2020 due to extremely high inventory levels and weak demand from the industrial, manufacturing and hospitality sectors.

Even a summer with higher-than-average temperatures would not improve the outlook for the rest of the year, several industry sources told S&P Global Platts.

Despite the conclusion of the country’s state of emergency to contain the spread of COVID-19 on May 25, several end-users said the negative impact of COVID-19 on industrial demand was only starting to emerge in June.

“Most factories in our region can’t run at full operations unless the entire supply chain is backed up by strong exports. Without this, our counterparts can’t predict demand accurately, so we also can’t have an accurate outlook on downstream demand and adjust procurement,” one Japanese gas company source said.

Among the Japanese end-users, city gas companies in particular have been troubled by “tank-top” or full storage tank scenarios. To alleviate this problem, multiple end-users have been activating remaining Downward Quantity Tolerance clauses in their contracts, deferring cargoes or using LNG vessels of all sizes to move LNG from one terminal to another. Several end-users told Platts they were even concerned about facing “tank-top” in August. This was a full month earlier than they had initially expected.

Further down the curve, another Japanese gas utility expressed concern about facing tank top in the fourth quarter.

POWER UTILITIES ALSO FACE WEAK INDUSTRIAL DEMAND

According to Platts Analytics, power demand for May was 91 GW, down 8 GW year on year. Over June 1-3, demand increased by 4 GW from the week before, implying a partial recovery. Yet, power demand from major industrial cities remained muted due to many factories not resuming operations, or operating only three days a week.

In addition, several end-users said the liberalization of the power market had made it even more difficult to regain the few percentage point losses in downstream sales this year. “A 100% recovery for energy demand is unlikely for at least a year or two. There could be some uptick in LNG demand because of cheap spot prices compared to term contracts or competing fuels, but it won’t be a speedy recovery like the one we see in China. We are not a fast-growing economy,” a third source at a major Japanese gas utility said.

Although thermal efficiency varies between Japanese power utilities and their different generation units, there was consensus that spot LNG prices was more competitive than coal – although this is subject to operating scale as larger utilities have more capacity to expand LNG power generation. “Current LNG prices are cheap so LNG power generation is running at a higher rate than coal. If storage allows, Japanese electric companies will buy LNG whether the JKM is $2/MMBtu or $3/MMBtu,” a source at a power utility in northern Japan said.

However, the inherent inflexibility of long-term LNG contracts make it difficult for Japanese end-users to adjust their commitments compared with coal. “We have no choice but to use LNG from long-term contracts so we are responding to COVID-19 by buying less coal in the spot market,” a source at a Japanese power utility based in the country’s western half said.

Already, market participants have observed a slowdown in opportunistic buying in the spot market by Japanese buyers. This was despite the JKM hovering at record low price levels, with June delivery JKM averaging at $2.107/MMBtu, while Brent-linked long-term contracts bottomed out at an average of $3.57/MMBtu for the same period. Since then, Brent-linked long-term contracts have recovered to approximately $4/MMBtu but the JKM for July delivery has remained around $2/MMBtu.

“Some Japanese end-users were deferring their long-term cargoes and buying spot. Now, they seem to just be dropping cargoes and not buying in the spot market”, a Japanese trader said.

Japanese utilities will continuously monitor their inventory level and use all possible measures to avoid facing tank-top.